Cotações

Todos os tipos de ativos

- Todos os tipos de ativos

- Índices

- Ações

- ETFs

- Fundos

- Commodities

- Moedas

- Cripto

- Título

- Certificados

Por favor, tente outra busca

🎁 💸 É grátis! Copie a lista de ações mais lucrativas da carteira de Warren Buffett, com lucro de +49,1% Copiar carteira

Mlc Wholesale Horizon 2 - Income (LP65093136)

Adicionar/Remover de uma Carteira

Adicionar à carteira

1,039

-0,003

-0,28%

- Classificação da Morningstar:

- Total do Ativo: 237,63M

Tipo:

Fundo

Mercado:

Austrália

Emissor:

National/MLC Group

ISIN:

AU60MLC06705

Classe de Ativo:

Ações

MLC Wholesale Horizon 2 Income Portfolio

1,039

-0,003

-0,28%

LP65093136 - Visão Geral

Nesta página, você encontrará um perfil aprofundado de Mlc Wholesale Horizon 2 - Income. Saiba mais sobre informações de gestão, ativos totais, estratégia de investimento e dados de contato de LP65093136, entre outras informações.

Informações de Contato

Endereço

PO Box 200

North Sydney,NSW 2059

Australia

North Sydney,NSW 2059

Australia

Telefone

+61 03 8634 4721

Fax

+61 02 9964 3334

Principais Executivos

| Nome | Título | Desde | Até |

|---|---|---|---|

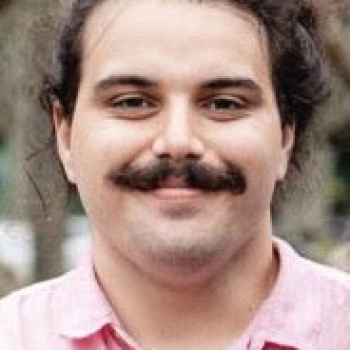

| Ben McCaw | - | 2008 | Agora |

| Biografia | Dr. Ben McCaw joined MLC in 2008 as a Senior Analyst in the Capital Markets Research Team, and has since become Portfolio Manager. Prior to joining MLC, Ben spent several years in the Australian cash equities market covering small and micro-cap companies in the emerging technologies sector. Since joining the Capital Markets Research Team, Ben has further developed and adapted his investment skills to multi-sector strategies by working closely with Susan Gosling on the continual evolution of MLC’s scenarios approach. Ben has played an important role across MLC’s scenarios process with a particular focus on research, modelling and application of the process to portfolio to management. His work has strengthened the foundations of the scenarios process. He plays a key role in both the operation of the process and it's evolution through time as Portfolio Manager. Prior to entering the investment industry in 2004, Ben spent two years as a post-doctoral researcher at the National University of Singapore. Ben has post graduate qualifications in both finance (Master of Applied Finance) and science (PhD). | ||

| Grant Mizens | - | 2006 | Agora |

| Biografia | Grant is Assistant Portfolio Manager in the Capital Markets Research team responsible for asset allocation across MLC’s diversified portfolios. He re-joined the team in 2014 and is involved in the team's asset allocation work, including scenarios and asset class modelling. Grant has worked at NAB Asset Management since 2006. His main focus has been portfolio construction and manager research for MLC's equity portfolios. Before re-joining the Capital Markets Research team he was a Senior Consultant in the JANA Advice and Research Team, focussing on Australian shares. Grant has a BA (Econ) from the University of Illinois and a Diploma of Financial Management from Finsia. | ||

| Kerry Gill | - | 2005 | Agora |

| Biografia | Kerry joined the Capital Markets Research Team as an Investment Analyst in May 2005, becoming a Senior Investment Analyst then Assistant Portfolio Manager in 2014. Kerry’s key responsibilities include investment research, scenarios modelling and asset allocation analysis across all of the MLC diversified products. Prior to joining, Kerry worked for the NSW Government as an economic analyst in the Revenue Strategy division of NSW Treasury and as an economist focused on Sydney metropolitan water pricing at the Independent Pricing and Regulatory Tribunal of NSW. Kerry has a Bachelor of Commerce (Finance) and a Bachelor of Science (Mathematics) from the University of New South Wales and a Master of Economics from Macquarie University. | ||

| Al Clark | - | 2019 | 2023 |

| Biografia | "Al recently joined Colonial First State Investments in April 2023 as Head of Investments, where Al and the team are responsible for managing Colonial’s range of multi-sector fund offerings. Al has close to three decades of experience investing in diversified funds, having constructed and managed multi-asset portfolios for institutional and retail clients since the ‘90’s. Prior to joining Colonial, Al was Head of Investments at MLC Asset Management where his team was responsible for managing all the Choice diversified funds. Previous experience for Al has included stints offshore, first as Head of Multi-Asset, Asia for Schroders in Singapore followed by time as Global Head of Multi-Asset for Nikko in Tokyo. Al has also worked in asset management for local firms BT and Macquarie. Al started his investment career as trader on the Sydney Futures Exchange in the early ‘90’s. Al has a Masters of Applied Finance from Macquarie and Bachelor of Science from the University of Canberra" | ||

| John Woods | Portfolio Manager | 2016 | 2021 |

| Biografia | John Woods, Portfolio Manager (Tailored Portfolio) BEng, Mcom, CFA John Woods joined MLC as a Portfolio Manager in June 2016. He is a co-Portfolio Manager for all the portfolios managed by the Capital Markets Research team and has a particular focus on the tailored portfolio, which aims to deliver absolute returns from direct listed investments. Previously, John was a microstrategy analyst at CLSA for 5 years and was responsible for firms equity strategy product in Australia. Prior to this, John was part of the Asia equity strategy team at Macquarie Group in Hong Kong, covering microstrategy products in 11 Asian markets. Before focusing on equity strategy, John worked as a fundamental analyst with Macquarie in Sydney, researching on telecommunications companies. He has also held positions as a consultant with IBM and as an engineer with Honeywell. John holds an MCom and a BEng (hons) from the University of New South Wales. He is a CFA charterholder. | ||

| Susan Gosling | - | 2002 | 2019 |

| Biografia | Dr. Susan Gosling joined MLC’s Investment Management Team in October 2002. She has been the architect of MLC’s market-leading scenarios based approach to asset allocation, which is the foundation for MLC's active investment process. Commencing her career in London as an economist with the Economist Intelligence Unit, Susan later became an Economic Adviser with the National Economic Development Office. Susan has held a number of senior positions in the funds management industry including General Manager of MLC Implemented Consulting, CIO with both Advance Asset Management and United Funds Management, founder and director of United Funds Management, a director of the Australian Investment Managers Association and founding director of a boutique private equity fund focused on consistency of economic and environmental sustainability. Susan has also held the position of General Manager Risk Management with Commonwealth Funds Management where in the late 1980s she commenced the development of a scenarios approach to asset allocation. The philosophy underlying this process and the implementation of the approach has been progressively developed and honed over the past 25 years. MLC scenarios approach to asset allocation is ‘state of the art’ and is without peer domestically and is a leader globally. Susan was recently named Investment Manager of the Year in the Women in Finance Services Awards which recognises the contribution her work has made to the industry. | ||

| Ian Carmichael | - | 2008 | 2013 |

| Biografia | Ian is a partner of Fairlight Asset Management, serving as a senior portfolio manager in the investment team since the inception of the Fund in 2018. Ian has 15 years experience in financial markets and a further six years as an engineer. Prior to joining Fairlight, Ian worked at Platinum Asset Management for four years as consumer team leader and managed an allocation of the highly respected International Brands Fund. | ||

Anexar um gráfico a um comentário

Confirmar bloqueio

Tem certeza de que deseja bloquear %USER_NAME%?

Ao confirmar o bloqueio, você e %USER_NAME% não poderão ver o que cada um de vocês posta no Investing.com.

%USER_NAME% foi adicionado com êxito à sua Lista de bloqueios

Já que acabou de desbloquear esta pessoa, você deve aguardar 48 horas antes de bloqueá-la novamente.

Denunciar esse comentário

Diga-nos o que achou desse comentário

Comentário denunciado

Obrigado!

Seu comentário foi enviado aos moderadores para revisão